Information To Dwelling Enchancment Loans

In case your cozy fireside is in dire want of a complete overhauling and you’re hesitant due to a low credit score rating, a subprime mortgage can come to your assistance. One on-line lender provided me an rate of interest that was a little decrease than the credit union, but in addition they wished a second mortgage on my house (the credit score union did not) and the funds can be very difficult to satisfy because they solely wanted to finance the loan for seven years (the credit score union offered ten).

This may work very smoothly in case your mortgage and residential improvement mortgage do not overflow your out there fairness mark. Some state packages comparable to Home-owner Emergency Repair Assistance for Seniors Applications will offer low interest loans to restore houses for low earnings householders who are at the very least sixty two years old.

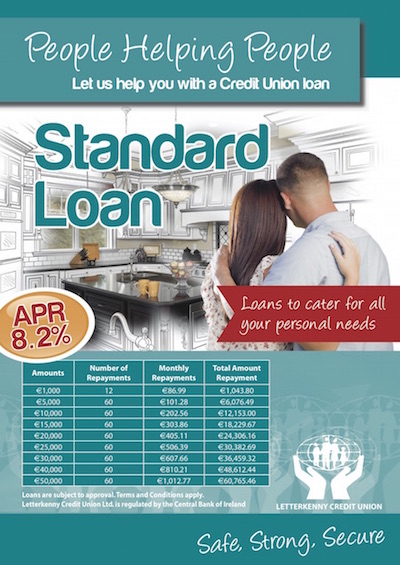

If you are trying an power conservation venture like new insulation or furnaces, they offer low interest loans. For those who apply for residence improvement loans from $1000 to $15000, you would be entitled to low interest rates as well as long amortization terms.

The thought process while taking loans is nearly at …